About Bitcoin

Bitcoin was designed as an alternative payments system that could function independently from any authority, such as a government, central bank or commercial bank. Since its inception in 2008, Bitcoin has been the centre of many controversies. Despite having a vague legal status within the financial ecosystem, Bitcoin has managed to beat the odds and reach adoption levels many never thought possible.

Invest In Bitcoin

Millions of users

Over a million BTC addresses make transactions daily, and it’s predicted there are over 100 million Bitcoin users worldwide.

High market value

The price of Bitcoin has exceeded $60,000, and the market cap has surpassed $1.1 trillion.

Active trading

Across dozens of Digital Currency exchanges, tens of billions of dollars worth of BTC is exchanged daily.

Active spending

Of the approximately 18 million BTC in circulation, hundreds of thousands are spent daily.

* Start Trading Now.

Why trade Bitcoin?

* Start Trading Now.

BTC/USD CFD Specifications

At Money Enhancement, we offer two BTC/USD CFD instruments. One is a standard contract, and the other is a mini contract. When you trade BTC/USD, the base asset is Bitcoin, and the quote asset is US dollars. The standard contract size, often referred to as the Lot size is one BTC; therefore, the smallest order size you can enter is 0.01 BTC. For some traders, that’s too much exposure; therefore, we offer a BTC/USD mini contract. The contract size is 0.01 BTC; hence a micro-Lot is 0.0001 BTC.

BTC/USD is quoted with two decimal places. The second digit is known as the Pip. The value of a Pip depends on the size of the contract. If you open a position for 1 Lot of BTC/USD, the Pip value will be $10, whereas if you open a position for 1 Lot of BTC/USD mini, the Pip value would be $0.10.

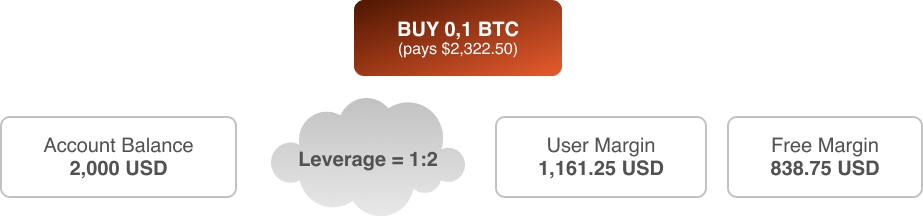

One of the benefits of CFD trading is you can trade with leverage to reduce how much capital needed to open a trade. Money Enhancementoffers up to 1:2 leverage for trading BTC/USD, which means you only need to provide a 50% margin to open a position.

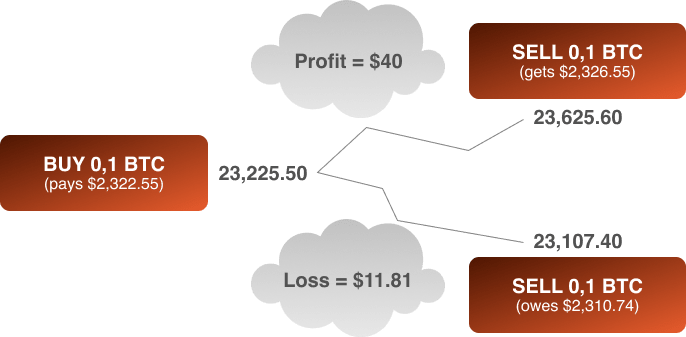

How a CFD transaction works

When you go long on BTC/USD, you’re technically buying BTC with dollars. When you close the trade, your profit or loss will be calculated in dollars. If the price of Bitcoin increased against the dollar, you’d get more dollars when you close the transaction. If the price of Bitcoin falls, you’ll get back fewer dollars.

With leverage, you’re able to open larger positions than your capital would otherwise permit. When you trade Digital Currency CFDs with Money Enhancement, you’re able to access leverage as high as 1:2; it means you only need to provide the margin to cover 50% of the position’s value.

When you trade Digital Currency CFDs, you don’t need to own either of the assets or currencies included in the pair. For example, if your trading account balance is funded with British pounds, you can still trade BTC/USD. The purpose of a CFD is to allow traders to speculate on an asset’s price without having to purchase it or own it. When a CFD is concluded, it will always be settled in cash by increasing or decreasing the amount of balance in your trading account.

Costs to trade BTC/USD

There are different costs involved when trading CFDs with Money Enhancement. There are three primary factors which influence how much you pay for your transactions; they are:

The size of your trade, the bigger the trade, the higher the fees.

The instrument you’re trading, as different products have different characteristics.

The type of account you have, as different accounts have different conditions.

Digital Assets with Money Enhancement

Discover the world of

Trade dozens of Digital Currencies in a professional and regulated trading environment by opening a CFD trading account with Money Enhancement.

* Start Trading Now.